Fertility treatment financing

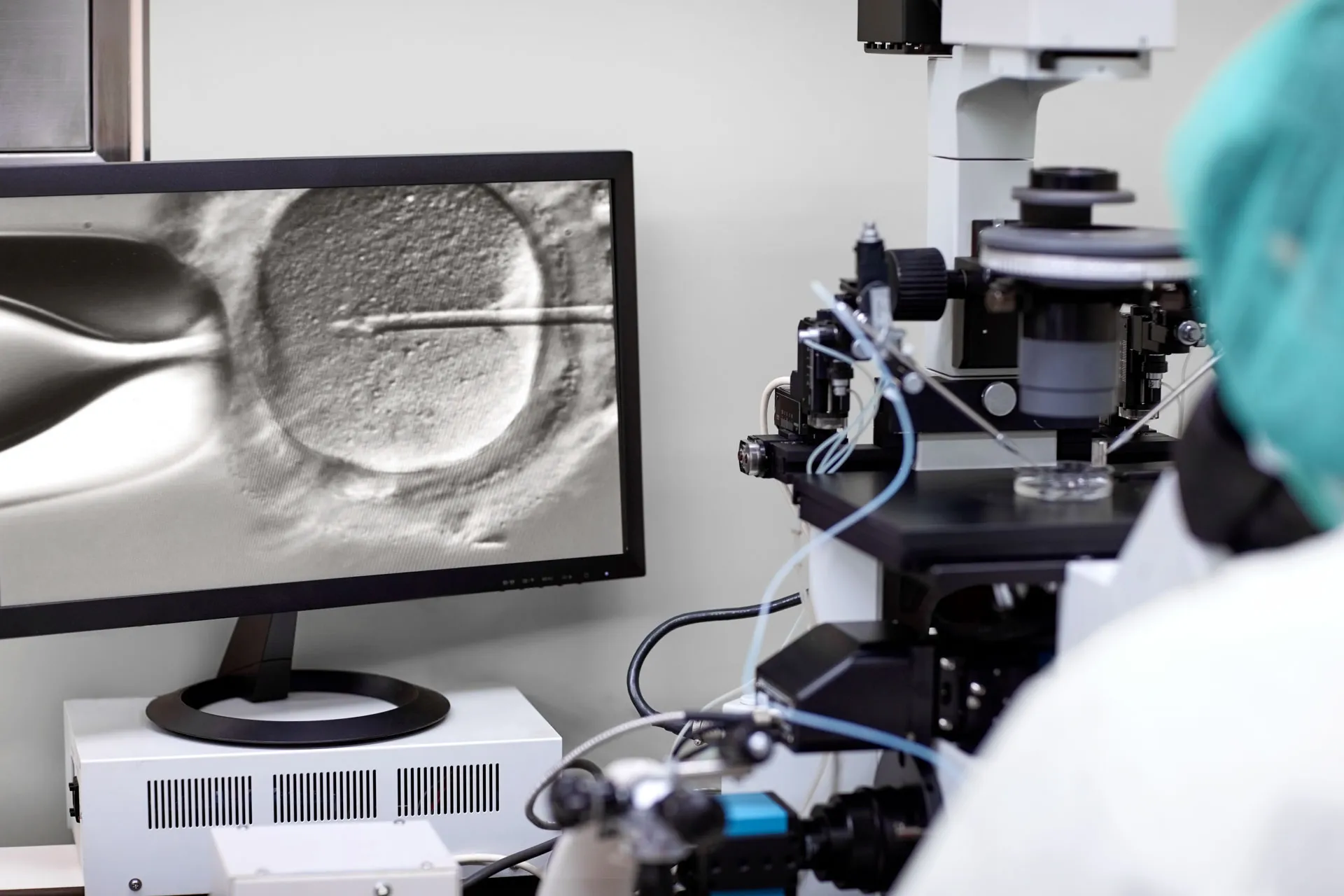

Loans for IVF & fertility treatments

The journey to conceive can be stressful. Prosper takes the worry out of financing fertility medications and procedures.

Checking your rate will not affect your credit score