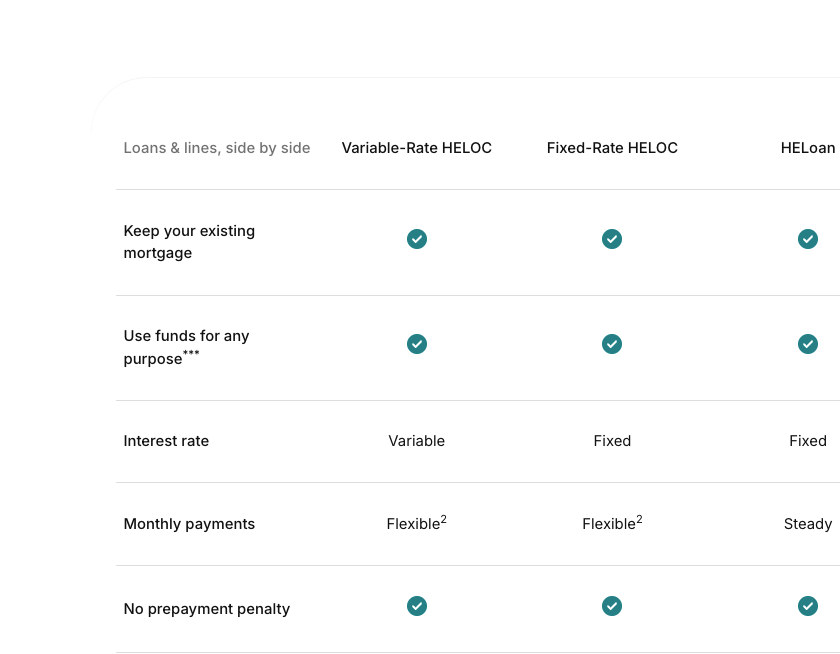

Home Equity Line of Credit

HELOC rates as low as 7.40% variable APR1

The simplest way to turn your home equity into flexible funds. See your interest rate and credit limit in minutes, with no impact on your credit score.

- Only pay interest on what you use2

- Flexible line of credit for any use***

- Closing costs as low as $0

- Lock in your low, fixed rate

- Get approved for up to $249k*

- Funding in one lump sum for any use***

- Jackson got an offer!

$120,000 Credit limit

$1,025 Est. mo. payment⁵