Fertility Treatments in the United States – details: From April 16 – 21, Prosper Marketplace sponsored a study of 213 American females between the ages of 25 and 54 from MarketCube, a research panel company, about their experiences trying to conceive a child with fertility treatments.

Each respondent had to meet the following criteria to participate:

- Female

- Between 25 – 54 years old

- U.S. resident

- Either actively trying or have tried to have a child and experienced difficulty conceiving (defined as at least six months of trying prior to pursuing treatment)

- Are actively going through or have gone through fertility treatments

In This Article

Context

According to the CDC, 12 percent of women of childbearing age (15-44) have received treatment for infertility – a total that equals 7.3 million U.S. women.[1] Even considering this scope, though, it’s exceedingly rare for health insurers to cover the majority of the cost incurred by infertility treatments. In many cases coverage at all is a rarity.

Just 15 states have passed laws that require insurers to cover infertility diagnosis and treatment, while an additional 13 states have laws that require insurance companies to cover infertility treatment.[2] According to the American Society of Reproductive Medicine (ASRM), the average cost of an in vitro fertility treatment cycle is $12,400.

Our study found that the majority of women (84 percent of those surveyed) undergo at least two cycles of IVF, and as a result are struggling with the financial implications of infertility. The majority of respondents have incurred considerable debt (especially credit card debt) as a result of these treatments. In fact, our survey found that the financial implications of infertility far outweighed the health or emotional concerns.

Also of note is the large disparity between women incurring credit card debt as opposed to debt from alternative lending options, many of which can offer considerably lower interest rates and more favorable repayment terms than traditional credit cards.

Prosper Marketplace conducted the survey to better understand the challenges that women are facing when it comes to financing fertility treatments. In February 2015, Prosper Marketplace acquired American Healthcare Lending, now Prosper Healthcare Lending. The company, which is one of the fastest growing providers of patient financing, gives Prosper Marketplace the opportunity to bring consumer-friendly personal loan options to people who need to finance their medical procedures.

The healthcare industry is plagued with high deductibles and spotty customer service. We see a huge need for consumer-friendly, competitively priced financing alternatives for people whose elective medical procedures aren’t covered by insurance or fall below the deductible.

KEY FINDINGS

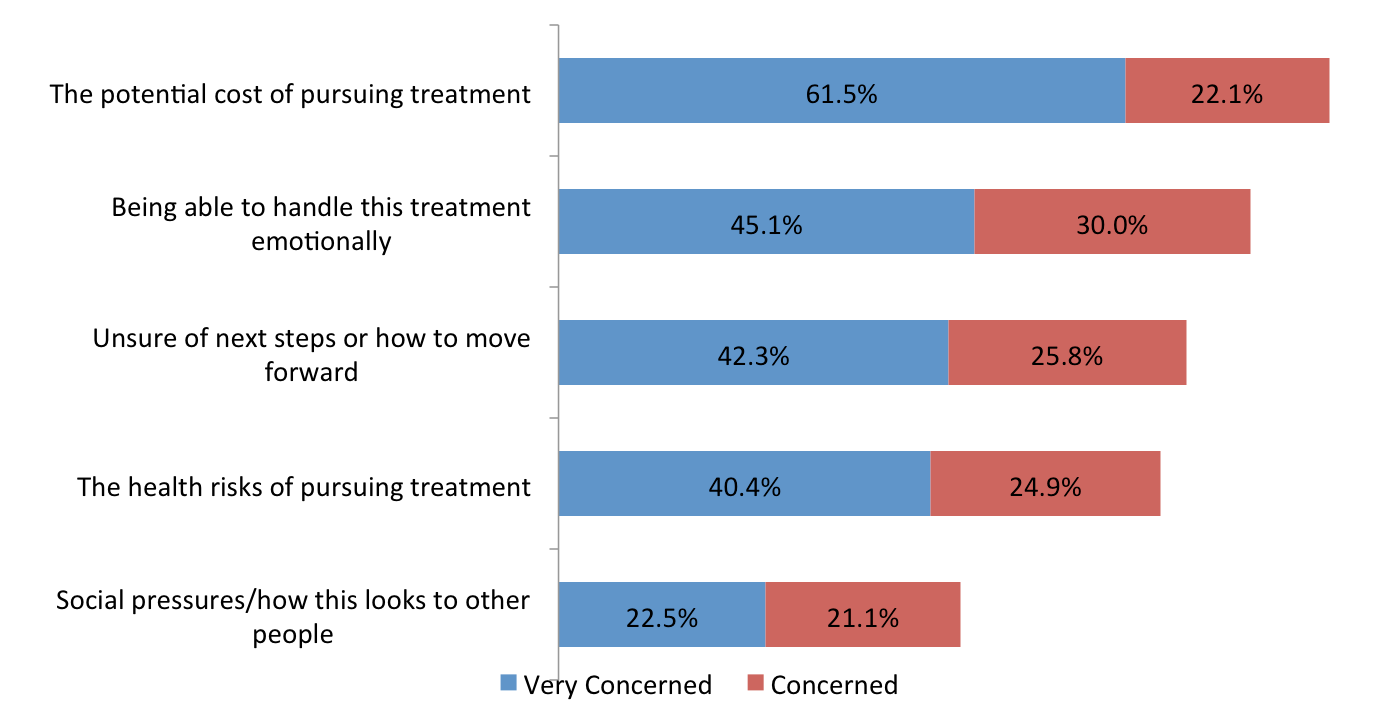

BIGGEST CONCERNS ABOUT FERTILITY TREATMENTS

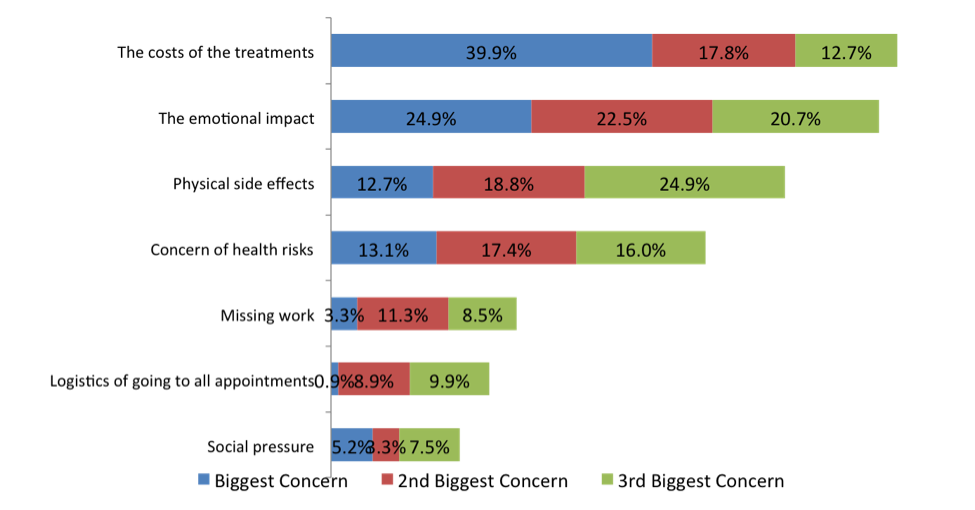

Cost is by far the most significant concern for women undergoing infertility treatment, with nearly 84 percent of respondents saying they were concerned or very concerned about financing treatments.

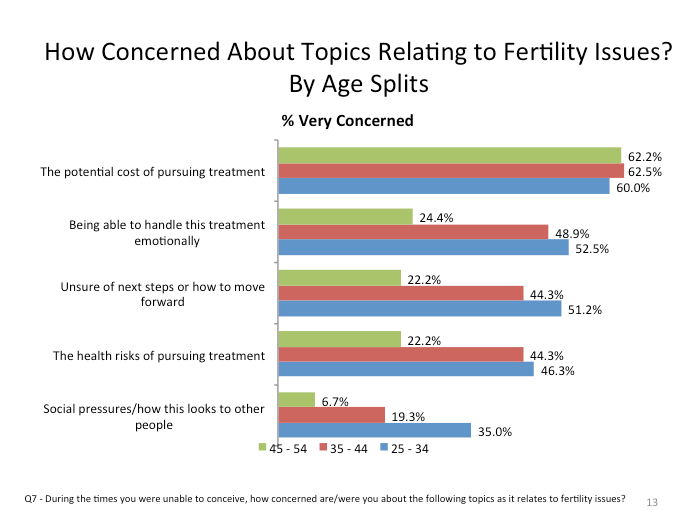

When we break out by age groups, the numbers shift in some interesting places. While cost remains the single-biggest concern across the board, the younger set is far more concerned with the emotional and societal pressures than older respondents.

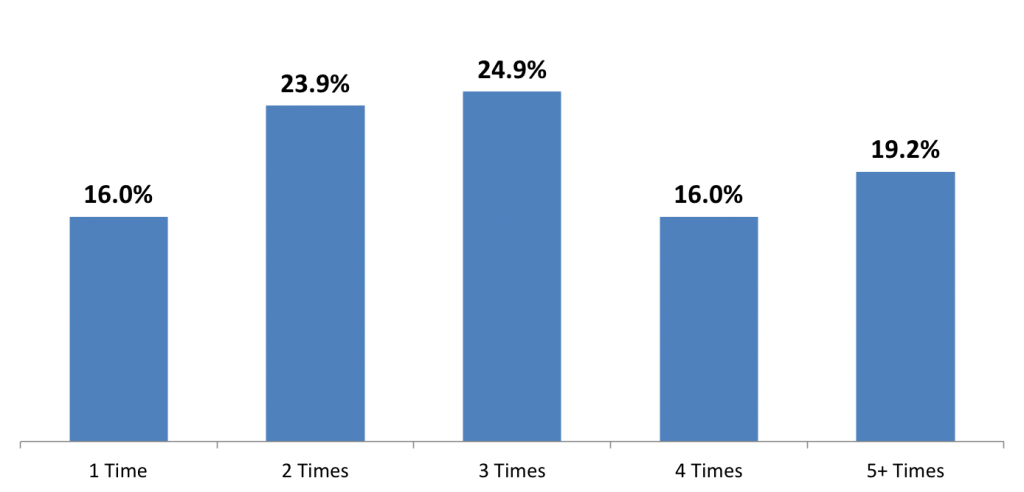

Fertility Treatments in the United States: NUMBER OF FERTILITY CYCLES

The majority of respondents have completed 2+ fertility cycles to date.

PROFILE OF FERTILITY CYCLES

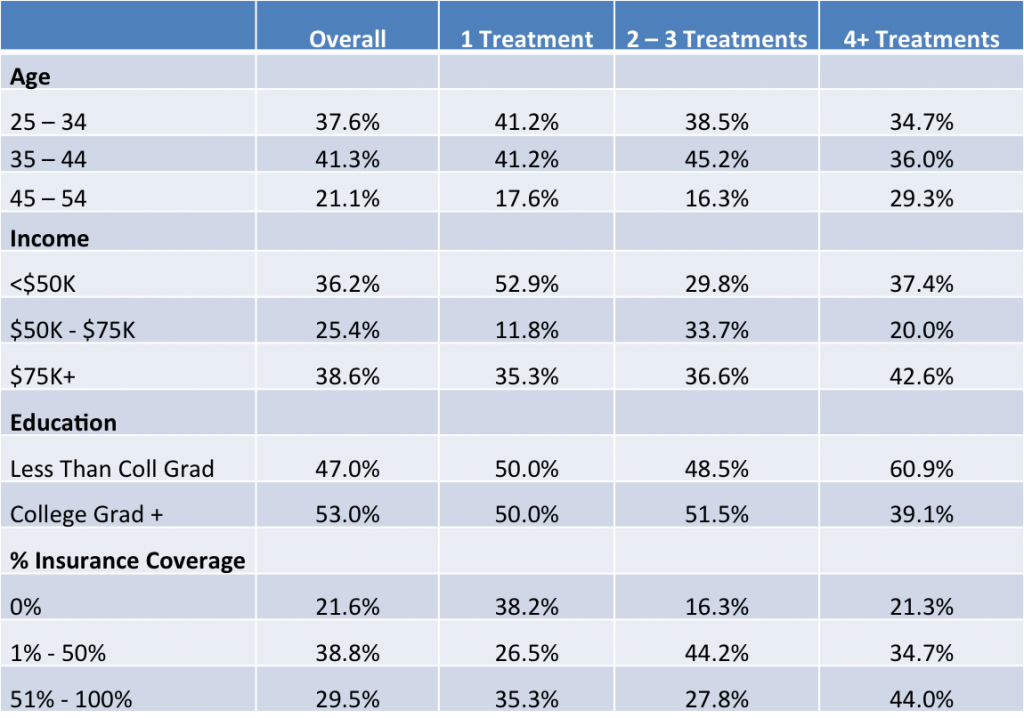

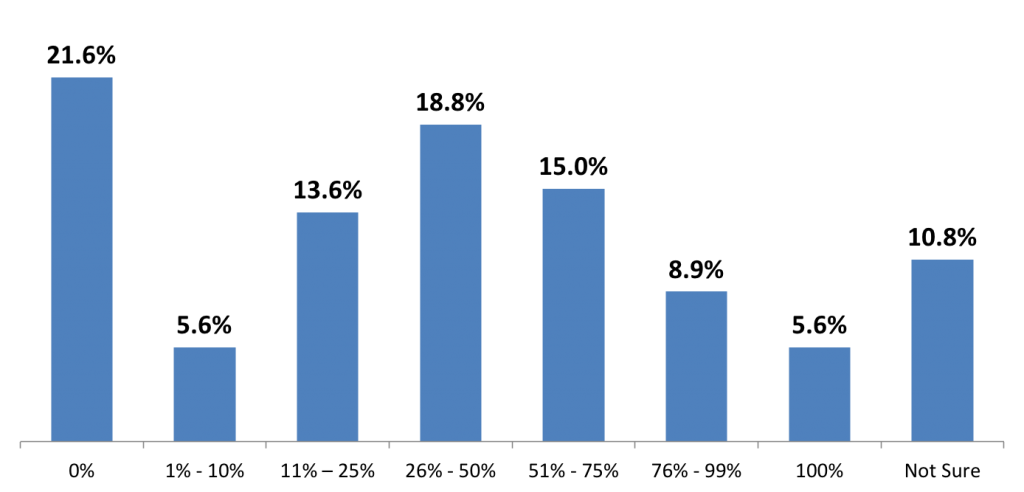

Fertility Treatments in the United States: PERCENTAGE OF COSTS COVERED BY INSURANCE

In a majority of cases, insurance covered less than 50 percent of the total cost of fertility treatments. For more than 20 percent of those surveyed, insurance covered nothing.

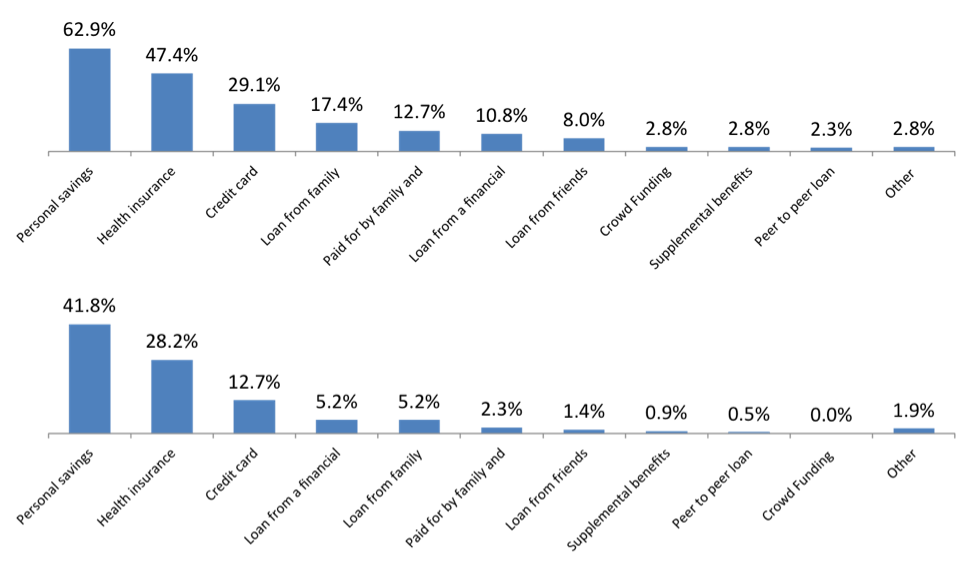

Fertility Treatments in the United States: PRIMARY PAYMENT METHODS

Fewer than 30 percent relied on health insurance as their primary payment method (top chart refers to whether a payment method was used at all in paying for fertility treatment; bottom chart refers to primary payment method for fertility treatment).

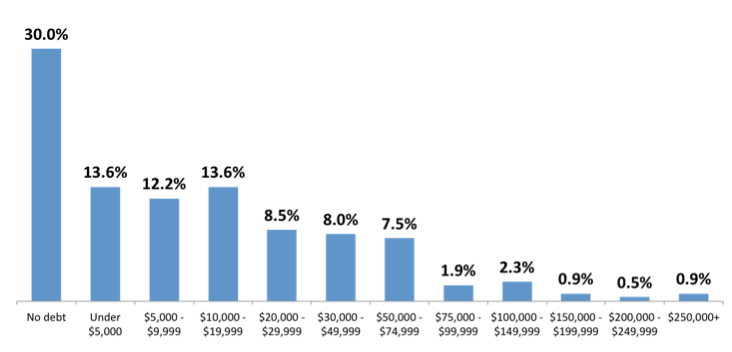

TOTAL AMOUNT OF DEBT FROM FERTILITY TREATMENTS

70 percent of those surveyed incurred some degree of debt from their fertility treatments. Nearly half (44 percent) incurred more than $10,000 in debt from fertility treatments. For younger women (25-34), this jumped to 52.4 percent incurring more then $10,000 in debt. For the same age, more 26 percent reported incurring more than $30,000 of debt.

Fertility Treatments in the United States: TOTAL DEBT FROM THOSE USING CREDIT CARDS

Respondents that used credit cards to pay for at least part of their fertility treatment were more likely to incur at least $10,000 in debt. Also of note, less than three percent of respondents relied on peer-to-peer loans, an increasingly popular and effective way to consolidate credit card debt, as a form of payment.[3]

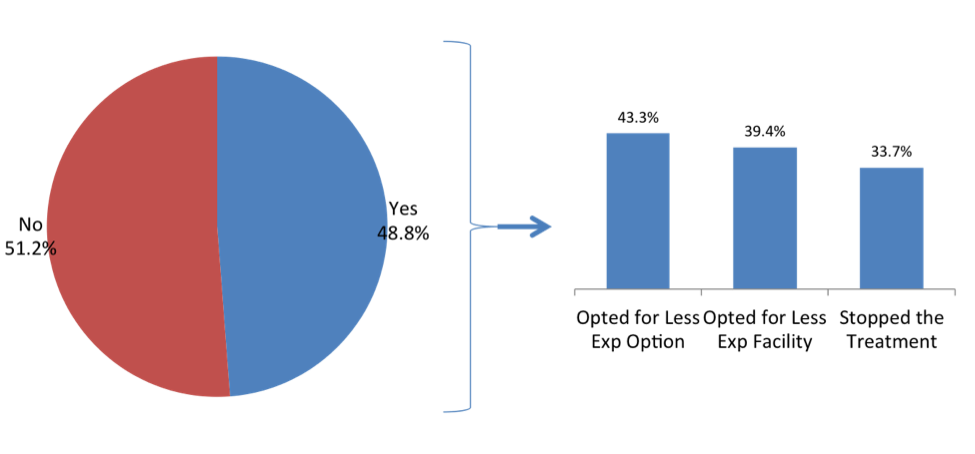

HOW COSTS IMPACT TREATMENT CHOICES

For nearly half of those polled (49 percent), costs impacted the level of treatment they ultimately chose to pursue (less expensive treatment or facility). Almost 34 percent of those women had to stop treatment due to costs.

BIGGEST CONCERNS RELATED TO FERTILITY TREATMENTS

Once treatments began, cost remained the single largest concern – closely followed by the emotional impact of fertility treatments.

REASONS FOR DELAYING TREATMENT

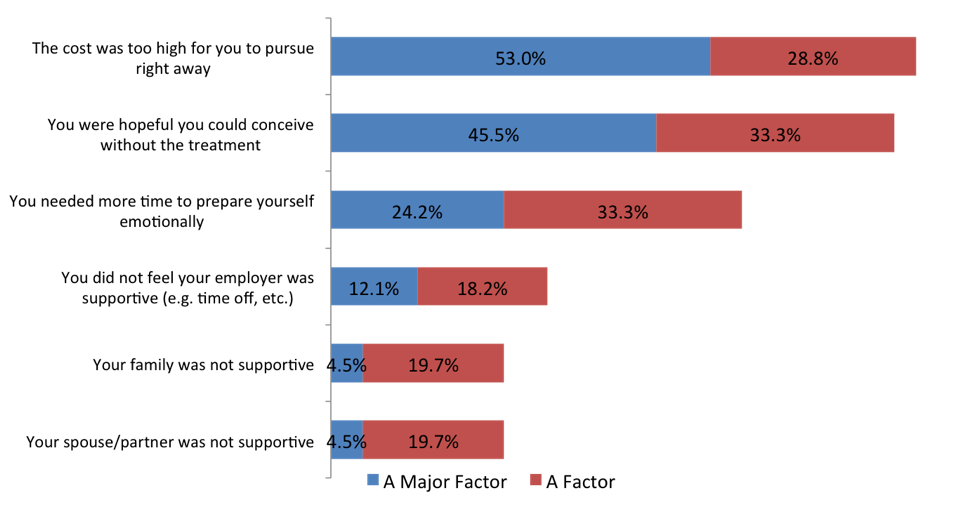

The cost of treatments was also the single largest factor for those respondents that initially decided to delay fertility treatment – nearly 82 percent.

PUTTING OTHER FINANCIAL GOALS ON HOLD

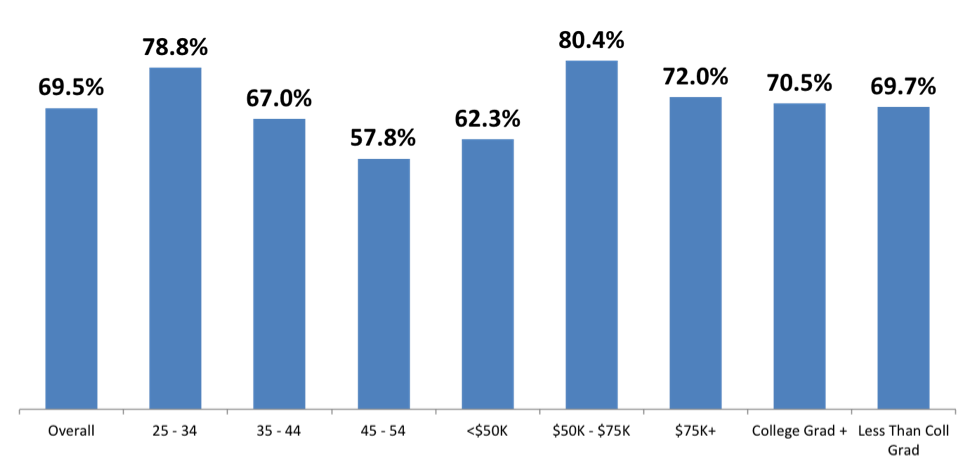

Nearly 70 percent of those surveyed put other financial goals on hold to receive fertility treatments. The primary things put on hold were travel and buying a home.

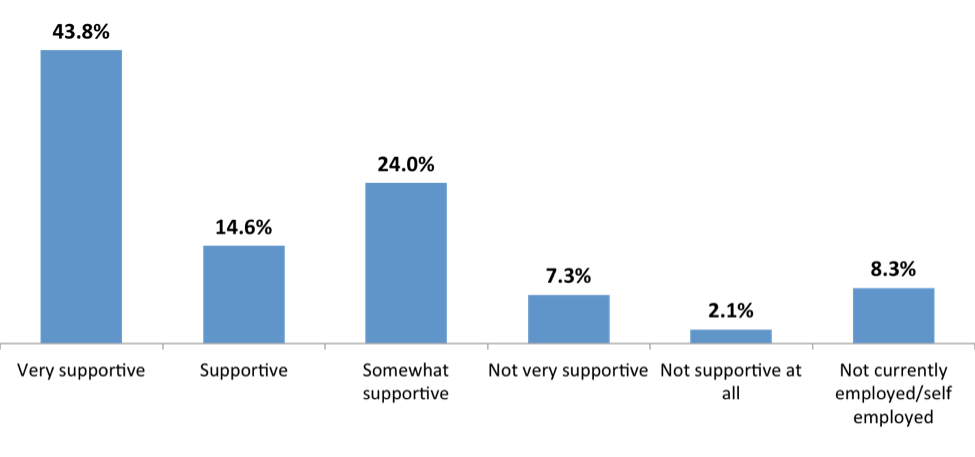

SUPPORT AT WORK

More than 33 percent of respondents reported their employers to be less than “Supportive” of women’s health issues. Getting time off was the most prevalent issue with those that felt their employers were not supportive.

(Source: Market Cube)

[1] http://www.cdc.gov/nchs/data/nhsr/nhsr073.pdf [2] http://www.ncsl.org/research/health/insurance-coverage-for-infertility-laws.aspx [3] http://www.huffingtonpost.com/shindy-chen/get-out-of-credit-card-de_b_6062878.html