Just like the Grinch, fraudsters and scammers love taking advantage of unsuspecting people. Unfortunately, the holidays give them plenty of opportunities to do so. With the rise of holiday scams, it’s important to stay vigilant and protect yourself from any suspicious activity.

During the season of giving and goodwill, don’t be surprised if you receive more suspicious calls, texts and emails than usual.

You might even feel more compelled to donate to a holiday fraudster’s fake charity or claim a “free” gift before a too-good-to-be-true offer expires.

But think twice before you click, download or respond! Make sure you know how to spot these common holiday scams, so you can avoid giving away your holiday joy to a Grinch.

In This Article

7 holiday scams and how to avoid them

Before making any purchases or responding to unknown numbers, learn to spot these common holiday scams and protect yourself.

1. Online shopping scams

Online shopping scams are the most common crime reported to over 65 consumer protection agencies worldwide.

According to the Federal Trade Commission (FTC), scams on social media also have the most reported losses. However, you could be at greater risk for this scam during the holidays since it is peak online shopping season.

Online shopping scams start when you visit a fake website that may even look like your favorite retail site. Then, victims are tricked into providing payment information and may be compromised further by logging into the site via social media or downloading an app with malware.

Tip: Only shop on secure websites that have “https” and a padlock symbol in their URL.

2. Charity scams

Charity scams take advantage of people’s generosity around the holidays. These scams usually involve calls or emails where someone asks you to donate to a fake charity, often by sending cryptocurrency, a gift card or money by wire.

Even if it’s a cause you support, resist the pressure to donate this way. Instead, research the charity so you can decide if you want to give directly.

Tip: Verify charities on your own, including name, phone number and address, before donating to them directly.

3. Gift card scams

Gift cards are one of scammers’ favorite payment methods because it can be impossible to track the recipient.

According to the FTC, only scammers will tell you to buy a gift card and give them the numbers off the back of the card.

Another red flag for gift cards and other holiday scams is being pressured to complete payment immediately to avoid a severe penalty or claim a prize. This tactic is meant to elicit a quick reaction and stop you from taking time to verify the details.

Tip: Avoid transactions where you’re pressured to pay with a gift card.

4. Travel scams

Travel scams can take several forms. This type of scam may start with someone calling and offering you a deep discount on a holiday vacation package or with a social media ad for a free or cheap vacation.

The offer could be for anything from a private flight to a timeshare or help with preparing your travel documents.

But to claim the “deal,” you’ll be asked to pay up-front fees or taxes. After paying, you’ll discover that you haven’t actually won or purchased anything.

Tip: If a reward is truly free, you won’t have to pay to claim it.

5. Imposter scams

Imposter scams are the most common type of scam reported to the FTC in 2024.

With imposter scams, the fraudster pretends to represent an organization you know or trust. They often pose as employees of the Social Security Administration or as tech support from a company or agency you do business with. These scammers can even spoof agency phone numbers with caller ID.

Another imposter scam involves someone posing as your relative and claiming they need money urgently. As tempted as you may be to help, you should always confirm the information by contacting your loved one directly.

Tip: Don’t confirm your personal information or send money to someone who makes unsolicited communication.

6. Delivery scams

The holidays are peak season for sending and receiving packages. Unfortunately, that makes targets more susceptible to delivery scams.

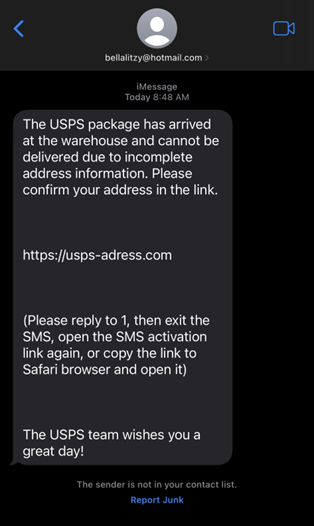

These smishing scams often start with a text message that says there’s a problem with your delivery, such as an incorrect shipping address. The message then urges you to click a link to fix the issue.

Scam text message example with misspelled “address.”

But when it comes to USPS tracking, keep the following in mind:

- The USPS doesn’t send unsolicited tracking texts

- Texts from the USPS always include the tracking number

- USPS text messages do not include links

Tip: Go to the source to look up the tracking information on your own.

7. Packing theft

If you’re waiting for a holiday package to arrive, you might not be the only one. Package theft is among the most popular holiday scams, and it simply involves stealing packages from someone’s porch or doorstep.

Porch cameras and delivery tracking help you reduce your chance of being targeted, but without those aids, you may not realize a package is missing until the thief is miles away.

Tip: Request delivery updates and pay attention to tracking information.

What to do if you suspect you’ve been the victim of a scam

If you suspect you’ve been the target of a scam, it’s important to respond quickly but carefully. Here’s what you can do:

1. Pause first

Most scams require you to take action to work. For example, you need to download an app with malware, click on a fake ad, or share your address over the phone.

If you suspect you’re in the middle of an active scam attempt, take a pause. Instead of clicking the link or asking questions to investigate further, cut off the communication, whether that means closing an email, text or abruptly ending a call.

2. Go to the source

Did you share your personal information on a potentially fake website or with someone who was possibly an imposter? If so, go directly to the source to confirm.

For example, if you responded to a text message informing you of a suspicious credit card transaction, call your bank to see if the message was legitimate.

3. Report the incident

Once you confirm that you experienced a scam, you’ll need to take steps to safeguard the information that was exposed.

This might entail working with your creditor to reverse a charge that resulted from credit card fraud and freezing or closing the account, contacting a credit bureau to put a credit freeze in place and filing a police report.

4. Safeguard

Last, you’ll need to take additional steps to prevent the scammer from doing further damage. Here are a few ways you can keep your information secure moving forward:

- Update your passwords and make sure each one is complex and unique

- Set up multi-factor authentication to prevent others from logging into your accounts

- Delete credit card information stored in your online profiles

- Review your financial accounts for unauthorized transactions

- Update your privacy settings on social media

- Keep an eye on your credit scores and reports to catch unusual activity, like new credit applications

If the scam resulted in identity theft, you could also visit IdentityTheft.gov for a personalized recovery plan.

Always think before responding

Scammers often try to create a sense of urgency. Why? Because they know that if you have time to think things over, you’ll likely notice the red flags.

Next time you receive an unsolicited message, pause before responding. You may even want to research and see if the sender is legitimate.

By practicing this simple precaution, you become your best scam prevention tool. Plus, you’ll improve your chances of having a peaceful holiday.

Written by Sarah Brady

Sarah Brady is a financial writer and speaker who’s written for Forbes Advisor, Investopedia, Experian and more. She is also a former Housing Counselor (HUD) and Certified Credit Counselor (NFCC).