Won’t affect your credit score

Personal Loans

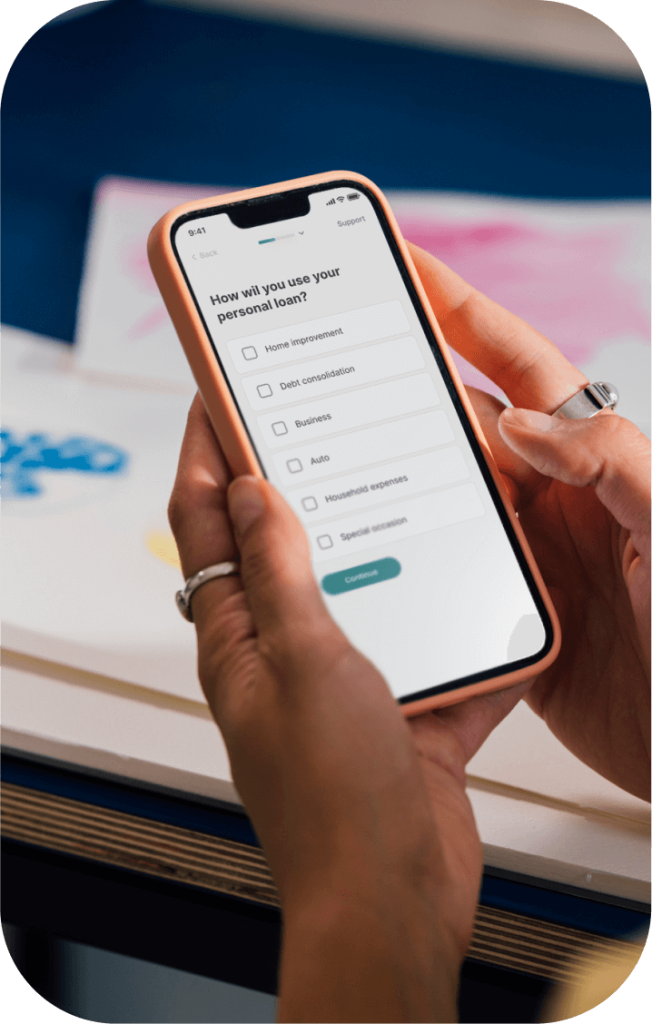

Choose your preferred offer and finish your application on any device.

Your payments don’t fluctuate with a fixed rate loan, making it easier to plan your budget.

Find personalized loan offers tailored to your needs and budget, at a glance in minutes.

4.7/5 Bankrate Score

4.7/5 Bankrate Score

For illustrative purposes only

Get your rate in minutes: Quickly see what interest rate and estimated monthly payment you may qualify for.

Choose your monthly payment: Choose a loan term and monthly payment that work best for you.

Get your funds as soon as 1 business day: Quickly and conveniently receive your money through direct deposit.

Won’t affect your credit score

Use a personal loan to cover just about anything you need. From consolidating debt to covering healthcare costs or paying for a special occasion, a personal loan through Prosper can help you meet your goals.

I have been a member since 2021 and have always had excellent service. It's been there for me when I needed it.

— Gail, December 2024

I’ve used Prosper many times to help me out. The online application is always easy. Highly recommend to family & friends.

— Suzanne, November 2024

My experience with Prosper has been quick, easy & effective! I've enjoyed working with them.

— Krystal, November 2024

Exceeds expectations. Professional, seamless, rewarding experience. The client service is why I keep coming back.

— Brian, November 2024

Quick and painless borrowing process. Prosper rates were lower than five other financial services companies.

— SkyWriter, November 2024

In interest on a 3-year loan with a monthly payment of $710 and an APR1 of 16.7%

For illustrative purposes only. Use the full calculator

The above calculation assumes consolidating $20,000 in debt at an average interest rate of 23%.

| Personal loan amount | 2yr term | 3yr term | 4yr term | 5yr term |

|---|---|---|---|---|

| $2,000 | $92.29 | $64.53 | $50.73 | $42.49 |

| $15,000 | $692.17 | $484.01 | $380.44 | $318.71 |

| $30,000 | $1,384.35 | $968.02 | $760.88 | $637.41 |

| $50,000 | $2,307.25 | $1,613.36 | $1,268.13 | $1,062.35 |

This chart uses 10% APR as an example. APRs on fixed rate loans through Prosper range from 8.99% to 35.99%. Your credit worthiness determines the APR on your offer.3

funded in personal loans

invested in personal loans

Our dedicated team of human specialists (not bots!) are available to answer questions and explain your options.

Prosper is a BBB Accredited Business and Norton Secured. Your data is secured by 256-bit encryption.

Get more support in the Prosper Help Center

A personal loan is money that you borrow from a lender and pay back in fixed monthly payments over a set period, such as 2 to 5 years. Most personal loans have a fixed interest rate.

Personal loans through Prosper are unsecured, which means they’re not backed by collateral like your home. Instead, our partner, WebBank, issues personal loans based on creditworthiness.

Personal loans through Prosper have fixed interest rates. For personal loans through Prosper, borrowers have the option to pay back their personal loans in 2- to 5-year terms.3

Prosper borrowers can use their personal loan for a variety of expenses. Some choose to use their loan for home repairs or debt consolidation, while others use it to fund big purchases.

Prospective borrowers can quickly and easily apply for a personal loan with nothing more than some basic personal and financial information.

Prosper makes it easy to apply for a personal loan and to check your rate and estimated monthly payments without affecting your credit score.

If you’re eligible for a personal loan, you’ll review your offers and choose loan terms that work best for you. Once you accept an offer, you’ll receive your money as soon as 1 business day after completing the necessary requirements.2

If you’re applying by yourself, you can also call us at 866-615-6319 to apply for a personal loan by phone. If you’re applying with another person, follow the steps above.

Your loan may be subject to 4 types of fees:

More information about these fees can be found in Prosper’s Help Center article. Current borrowers can also refer to your Borrower Registration Agreement and Promissory Note (stored in your online account) for more details about fees.

If you don’t qualify for a personal loan through Prosper, consider applying with a co-applicant.

Applying with a co-applicant could improve your chances of getting an offer. Plus, it might lower your rate. Your co-applicant should be someone you trust with strong credit and a steady job. Our partner WebBank issues personal loans based on creditworthiness. Borrowers who accept a personal loan through Prosper must have a credit score of 640 or higher to qualify for a loan.

You can’t deduct the interest you pay on an unsecured personal loan from your taxes unless you use the loan proceeds for business expenses, qualified higher education expenses, or taxable investments.

Business expenses are defined by the IRS as costs associated with forming or running a business. The interest that is associated with the loan taken out to form or run your business may be deductible, regardless of the size of your business.

Qualified educational expenses can be tax deductible if you use a personal loan to refinance a student loan or pay for eligible educational costs or expenses like tuition. Under these circumstances the personal loan may be eligible for the student loan interest deduction. You can read more about the student loan interest deduction and how it works here.

Taxable investments are defined as stocks, bonds, or mutual funds. Taxable investment deductions are not eligible with tax-advantaged investments, like tax-exempt bonds.

Remember that the interest from the loan is what is deductible, you can subtract the interest amount as an expense income, which can reduce your total tax liability for that year.

Most of these options require itemized deductions, which may not always make sense for everyone. You can read more about personal loans and tax deductions here.

Please note that this is not to be construed as tax advice, and we recommend seeking the advice of a tax professional for more information.

Every individual has a different and unique financial situation. That said, if your credit score is under 600, you might not qualify for a loan through Prosper.

The best way to know if you are eligible to receive a personal loan through Prosper is to apply. Checking your eligibility and rate will not affect your credit score.

If you are not eligible to receive a personal loan through Prosper on your own, you could consider adding a co-applicant. Adding a co-applicant could improve your chances of having your personal loan application approved.

Prosper’s mission is to advance financial well-being. We provide fast, simple financial solutions with personal loans, the Prosper® Card, and investing.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

1Eligibility for personal loans up to $50,000 depends on a number of factors, including (but not limited to) your financial history, credit score, monthly income, and monthly expenses. Eligibility for personal loans is not guaranteed, and requires sufficient investor commitments to fund. All personal loans made by WebBank.

2You may receive your funds one business day following your acceptance of the loan offer, completion of all necessary verification steps and final approval. One business day funding is also dependent on your bank’s transaction processing speed.

3Personal loans through Prosper have an annual percentage rate (“APR”) of 8.99% to 35.99%, terms between two and five years, and an origination fee from 1% to 9.99%. For example, a three-year $10,000 personal loan with an interest rate of 16.66% and a 8.99% origination fee results in a 23.53% APR. You would receive $9,101.00 and make 36 scheduled monthly payments of $354.84. A five-year $10,000 personal loan with an interest rate of 18.73% and a 8.99% origination fee results in a 23.26% APR. You would receive $9,101.00 and make 60 scheduled monthly payments of $257.92. Whether you are eligible for a specific APR or loan term will depend on a number of factors, including (but not limited to) your current credit rating and information you provide in your application. The lowest rates are for the most creditworthy applicants. Your actual rate may differ. The average APR for loans with a 3-year term funded between January 1, 2025, and June 30, 2025, was 23.53%.

Prosper and WebBank take your privacy seriously. Please see Prosper’s Privacy Policy and WebBank’s Privacy Policy for more details.Fixed rate in minutes Check your rate