HOME EQUITY LOAN CALCULATOR

Calculate your home equity loan rate & payment

Use this calculator to help estimate your personalized interest rate, payment, and loan amount with a home equity loan (HELoan) through Prosper.

Your info

Est. variable rate1,5

0%

Est. credit line4

$0

Est. monthly payment1,5

$0

Est. fixed rate

0%

Est. loan amount7

$0

Est. monthly payment6

$0

HELOC

Est. variable rate1,5

0%

Est. credit line4

$0

Est. monthly payment1,5

Est. mo. payment1,5

$0

Est. fixed rate

0%

Est. loan amount7

$0

Est. monthly payment6

Est. mo. payment6

$0

Enjoy our no-stress, speedy digital process

Enjoy our no-stress, digital process

This calculator is a self-help tool for your independent use and is intended for illustration purposes only. Results aren’t guaranteed, and may not be relevant to your specific circumstance.

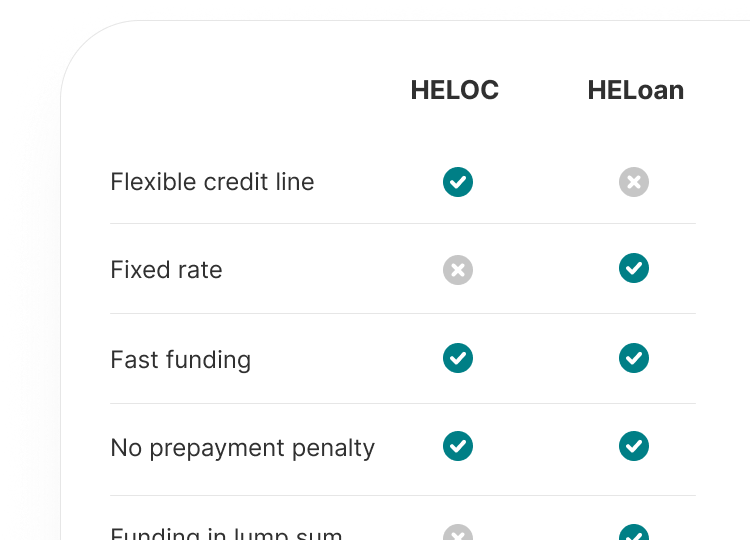

See your home equity options side-by-side

Explore your home equity options

Home equity line of credit (HELOC)

Home equity loan (HELoan)

About our home equity loan calculator

Back up to calculatorHow to use this home equity loan calculator

- Enter your desired funding amount. This number must be between $40K–$249k7 to be eligible for a home equity loan (HELoan) through Prosper.

- Enter your property details: state where your property’s located, estimated home value, estimated mortgage balance, and property type.

- Select your credit score range.

- Click or tap “Calculate”.

- The calculator will estimate the loan amount you may be able to borrow with a home equity loan through Prosper.

How these results are calculated

- Rate: This fixed percentage for a home equity loan is based on several factors, including your credit score, property characteristics, and the amount you want to borrow.

- Max. loan amount: This value is based on how much equity you have in your home, your credit score range, and your property’s location and primary use.

- Monthly payment6: For a home equity loan, the regular payment is your total balance divided by the number of months in the term you choose.

Home equity resources

See more home equity content

Pros & cons of home equity loans

Our guide to financing home improvements

How can we help you prosper?

We've got your back, every step of the way.

Chat with a dedicated Prosper team member, not a robot.

Answers to home equity questions, from your application to payments.

Home equity is just the beginning. Prosper has smart, simple tools for borrowing, saving, and earning with products like personal loans, a credit card, and investing.

About Prosper