For a limited time get up to 2% cash-back bonus on your investments.

Seize the blooming season and add to your investments. It’s easy, just deposit and invest a minimum of $1,000 in New Funds* between April 15, 2024 to June 30, 2024 to earn your cash-back bonus.

Cash-back bonus tiers

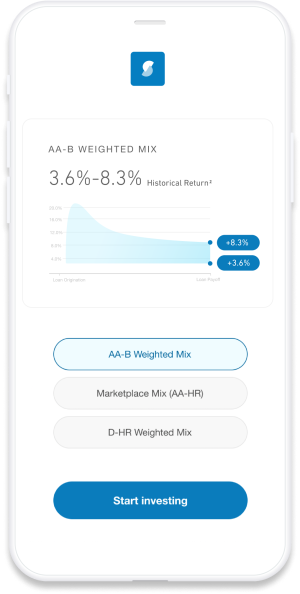

Invest in loans,

diversify your portfolio

- Average historical return of 5.5%¹

- Average 3 year rolling return of 6.1%²

- Over $20B invested since 2005

- Earn passive income as borrowers make monthly payments

Support when you need it

We’re here to help you every step of the way. Reach out with any questions.

- 877-646-5922

- [email protected]

All Notes offered by Prospectus.

Offer Terms and Conditions

The offer period for this promotional offer starts on April 15, 2024 at 12:00am (PST), and ends on June 30, 2024 at 11:59pm (PST) (the “Promotional Period”).

This offer is valid for (a) Prosper IRA accounts into which New Funds are deposited and invested by June 30, 2024 at 11:59pm PST, and (b) Prosper General Investing Accounts into which New Funds are deposited and invested by June 30, 2024 at 11:59pm PST. All bonus funds will be paid as an account credit to your Prosper General Investing Account by July 31, 2024.

For purposes of this offer, “New Funds” means the amount of net increase in the Available Cash in an eligible Prosper account (as displayed on the Summary account page of your Prosper account) resulting from the deposit (in one or more deposits) of funds from an external source, such as a contribution, direct transfer, or rollover from an IRA custodian, less any withdrawals of Available Cash, as measured on April 15, 2024 at 12:00am (PST) and July 1, 2024 (PST) at 12:00am (PST). “New Funds” do not include any amounts of principal and interest received on Notes held in the eligible Prosper account during the Promotional Period. Any funds transferred out of the eligible Prosper account during the Promotional Period will result in an equivalent reduction in the Prosper account’s total amount of “New Funds” for purposes of determining the qualification for and amount of the bonus.

For purposes of this offer, “invest”, “investment”, “invested”, or “investing” means New Funds that (i) have been used to purchase Notes through the Prosper platform by June 30, 2024 at 11:59pm (PST), or (ii) have been committed to loan listings on the Prosper platform that are pending origination as of June 30, 2024 at 11:59pm (PST).

To qualify for the 1.0% cash back offer, New Funds in the amount of $1,000 or more must be invested during the Promotional Period. To qualify for the 1.5% cash back offer, New Funds in the amount of $5,000 or more must be invested during the Promotional Period. To qualify for the 2.0% cash back offer, New Funds in the amount of $10,000 or more must be invested during the Promotional Period.

This offer is account specific and non-transferrable. One bonus offer per account. Account balances existing prior to 12:00am (PST) on April 15, 2024 will not be considered in determining qualification for and the amount of any bonus described in this offer.

Bonuses and account credits may be subject to U.S. withholding taxes and any taxes related to the bonus or credit are your responsibility. Prosper does not provide investment advice, and the information presented here is not intended to be investment, tax, or legal advice. You should consult your tax professional regarding limits on contributions, depositing and rolling over qualified funds, and to determine whether an IRA may be the right choice for you. This offer may be changed or discontinued at any time without notice.

Offer Reference Code: Cash Bonus Offer (Spring 24)

Footnotes

The Historical Return calculation (a) is updated monthly; and (b) excludes the impact of servicing related corrective non-cash adjustments that may modify the outstanding balance or status of a borrower loan. The actual return on any Note depends on the prepayment and delinquency pattern of the loan underlying each Note, which is highly uncertain. Individual results may vary. Historical performance is no guarantee of future results and the information presented is not intended to be investment advice or a guarantee about the performance of any Note.

2. “3 Year Rolling Return” is the weighted average three year rolling historical return for loans originated through Prosper’s standard product program, based on loan performance between April 1, 2021 and March 31, 2024 (the “3 Year Performance Period”). To be included in the rolling historical return (“3 Year Rolling Return”) calculation, the loan must either (a) have an active principal balance, or (b) be subject to a cash transaction that affects the loan’s balance, in each case during the 3 Year Performance Period. The 3 Year Rolling Return is based on actual payments (other than principal) received by the investor net of fees and losses (including from charged-off loans) on loans during the 3 Year Performance Period.

The Rolling Return calculation (a) is updated quarterly; and (b) excludes the impact of servicing-related corrective non-cash adjustments that may modify the outstanding balance or status of a borrower loan. The actual return on any Note depends on the prepayment and delinquency pattern of the loan underlying each Note, which is highly uncertain. Individual results may vary. Rolling historical performance is no guarantee of future results and the information presented is not intended to be investment advice or a guarantee about the performance of any Note.

Other Important Information

Prosper’s borrower payment dependent notes (“Notes”) are offered pursuant to a Prospectus filed with the SEC. Notes are not guaranteed or FDIC insured, and investors may lose some or all of the principal invested. Investors should carefully consider these and other risks and uncertainties before investing. This and other information can be found in the Prospectus. Investors should consult their financial advisor if they have any questions or need additional information.

Prosper Funding LLC

221 Main Street, Suite 300 | San Francisco, CA 94105

Contact Us | Terms of Use and Electronic Consent

© 2005-2024 Prosper Funding LLC. All rights reserved.