Business loans to

drive your success

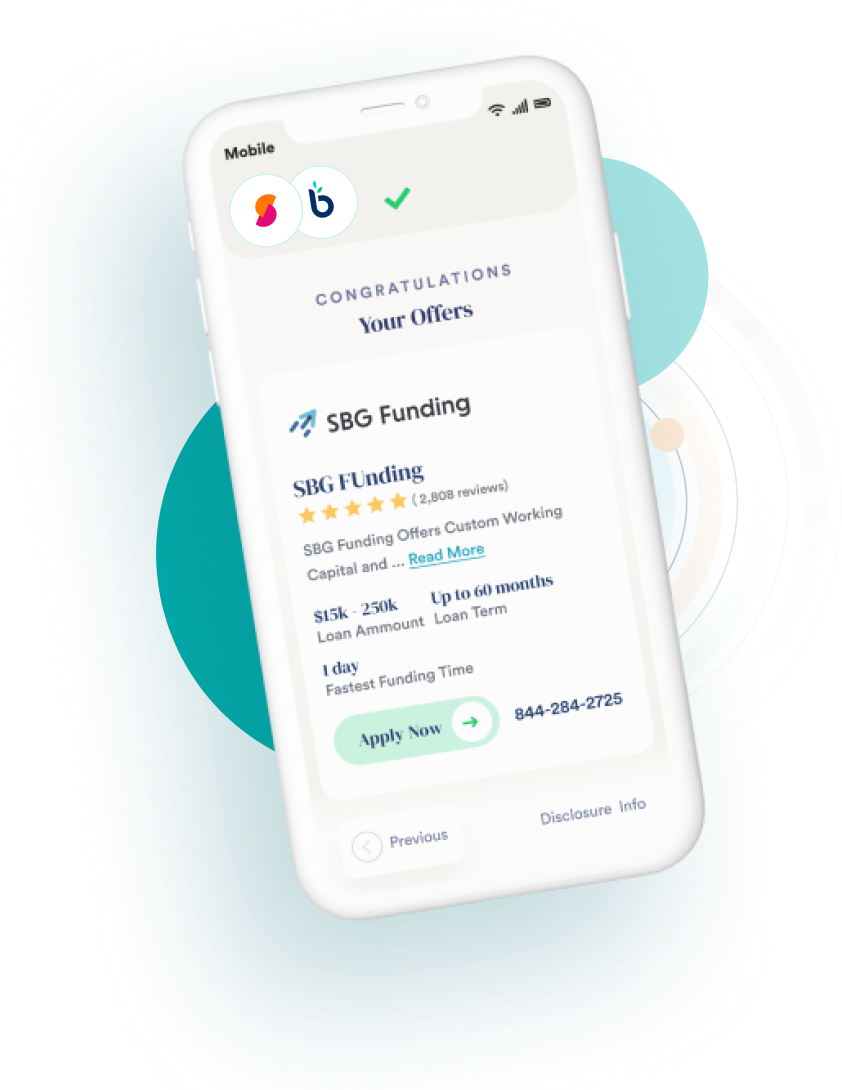

Strengthen your business with financing options through BusinessLoans.com

Quick, easy & simple funding for your business

Answer a few quick questions about your needs

Review your options all at once to find the best rate

Fuel your business with

up to $3M in funding

Small business loans to meet your needs

Financing options through BusinessLoans.com can be used for virtually any business expense—from purchasing equipment to increasing inventory, consolidating business debt, buying or expanding a business, or paying for business real estate or rent.

We’ve got the answers to your questions

BusinessLoans.com is a platform that connects businesses with potential lenders, providing them with various financing options tailored to their needs.

Timing for receiving approved funding depends on many factors. Each lending partner has its own approval process which can result in differing funding timelines. The typical time to fund can be anywhere from 24 hours to 1 week after you accept your loan offer, complete all necessary verification steps, and receive final approval. Rapid funding is also dependent on your bank’s ability to quickly process the transaction.

To secure a small business loan, you’ll typically need good identification, bank statements, etc. Exact requirements will depend on the lender.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.